We recently discussed the new Market Based Pricing that new or renewing contracts with realestate.com.au changes to from July 1st, 2014 but how will real estate agents around the country react to the changes?

Traditional industry news sites have now picked up on the story and the general feedback both here and on those sites has been fairly condemning and for many businesses that might spell trouble, but realestate.com.au has been there before. As far as they are concerned agents will whinge, whine, complain, stamp their feet, express their anger at their account rep and then forget about it and move on.

In comments sections on many articles you will see people express their discuss that we should support other portals, real estate institute websites and others as though they are the first one to come up with this solution and think it just takes the wave of hand. This same commentary has been going on since realestate.com.au started its year on year massive price increases. These days it is going to take a paradigm shift in the industry to dent their position let alone kick them out of the number one position.

The question then that has to be asked is will this pricing be the straw that breaks the camels back?

The executives at realestate.com.au have over the years proven themselves adept at poking us hard enough to hurt, but never hard enough for the industry to stop us loving them entirely.

Over the years I have had literally dozens and dozens of calls from people with grandiose plans of opening up a real estate portal to “beat” realestate.com.au at their own game, and of course to make themselves filthy rich !!!

My standard response is whatever you plan to spend on it in the first year, just send to me and walk away from the idea as that will be a damn site cheaper option for you. Just look at how Packer and Microsoft went going up against realestate.com.au. Despite having realestate.com.au worried at the time they folded like a pack of cards and I really don’t think anybody has worried them since.

Every year we have a new crop of competition who follow through enough to release a finished product. This year we seem to have a bunch of have a few new challengers like Homley.com.au who in my opinion has a fantastic modern design that I prefer. With history set to repeat itself most will fail and close their doors and some will battle on with the scraps that the tier one and the lesser extent tier two portals leave behind.

Don’t get me wrong, I think they watch and analyse their competition very closely, I just don’t think they make too many pricing decisions based on their competition.

Realestate.com.au are proudly trumpeting that the prices are now market based as though this is somehow going to make agents feel better. They even provide the requisite scenario where an agent will save money on this new plan. I believe like most prices changes before it 10 to 15% of agents will see some sort of modest reduction in their monthly spend. About 30 to 40% will receive a small to medium increase only but about 45 to 60% will attract significant rises in their total spend with the portal, if they continue to sell the same level of addon products.

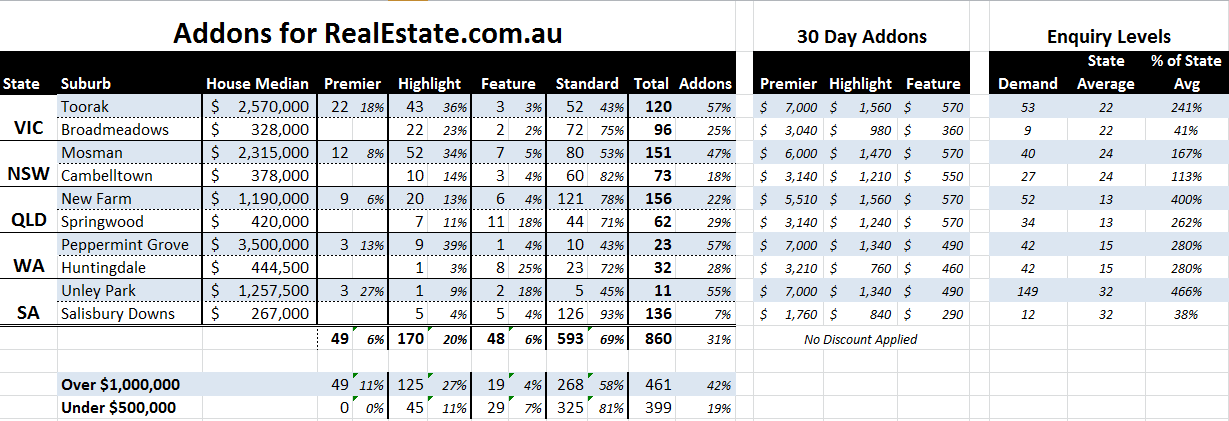

Because this new model relies so heavily on addon upgrades I did a quick look at the usage of add on products around mainland Australia. I tried to find representative suburbs below $500,000 and above $1m and looked at the use of these add on products. Realestate.com.au also claim that the demand or enquiry level of a suburb effects its pricing as well so I also grabbed the enquiry level that realestate.com.au is reporting for that suburb and the state as a whole.

(If anybody is interested in the excel spreadsheet then feel free to contact me)

I am not sure I understand the logic of paying $7000 for a Premier Property upgrade when there is only 11 properties in the suburb. Any buyer is going to look at all 11 properties and nothing is going to get lost on page 8 or 9 like some suburbs.

This is obviously not a comprehensive study but it does provide us with some interesting observations.

- Clearly the mores expensive suburbs see higher usage rates of addon upgrades. It roughly translates to about double the number of properties upgrading but more importantly the higher value suburbs really don’t bother too much with feature properties at all with Highlight and Premier properties being favoured.

- Suburb activity does seem to effect the pricing with those suburbs significantly below their states average seeing a reduction in the pricing of their upgrades. It will be interesting to see if these prices fluctuate yearly based on their changed market conditions.

- There appears to be limits in place for each upgrade option. Premier Property seems to have a ceiling of $7,000 per month and Highlight appears to have a ceilings of $1,560 with Feature Properties limited to $570. Remember that volume discounts of between 20 to 45% can be applied depending on what an agency signs up for.

The cost of a feature property has only moved marginally but the highest increases have been with Highlight and Premier Property options. Give the above it is clear that the biggest impact of this new Market Based Pricing will be for agents who operate in areas with median prices over $500,000. These prices appear to me to be in line with previous increases of and those operating in areas with a median price over $1,000,000 are going to see significant prices increases and cop the brunt of this.

Now for premium properties marketing costs like these are generally always Vendor Paid Advertising (VPA) so these price rises are going to hit the pocket of the wealthy home owners. That does not mean that agents will not feel this price rise. I wish every client pays their bills but they dont and agents will be left holding some bad debts.

Despite the new Deficit tax targeting the same demographic I think for the most party they can still afford it and even if they cant the standard or feature listings will still be available. The products that rise the most are all elective and the biggest danger for an agency is committing to specific volumes and the new prices turn out to be much harder to sell than the previous. Some agents are going to be left holding the bag of paying for their committed upgrades.

So will this new Market Based Pricing be disruptive to the company? I highly doubt it.

Obviously these higher prices are going to result in lower takeup but they are figuring that enough will still use the addon upgrades to deliver a hefty boost to their revenues. Their biggest risk is that the fallback in takeup negates the higher prices and delivers a revenue drop. Only time will tell but I would not bet against them in this.

As to outside forces, like always there are some risks on the horizon for realestate.com.au and some that are showing some hope but for now, none appear even capable of delivering a stiff jab let alone a knock out blow.

There are plenty that want to hop in the ring with this monster but up till now their record probably sits 200-0 with 195 knockouts.

Ding ding… next please!

The post What Will Be The Effect of Realestate.com.au 2014 Market Based Pricing? appeared first on Business 2.